All US citizens, resident aliens, and nonresident aliens who intend to or who will file a US income tax return for the purpose of receiving an educational tax credit need to provide their SSN/ITIN to the University. To verify your eligibility for education tax credits, WSU is required by federal law to report your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) and other pertinent information to the Internal Revenue Service (IRS) on Form 1098-T.

The IRS requires, in section 6109 of the Internal Revenue Code, that we request you to provide your SSN/ITIN. Without a valid SSN or ITIN, WSU may not report the educational expenses paid by you in this tax year, and your ability to claim an eligible tax credit may be delayed. This is why concurrent high school students, Kansas residents 60 and older auditors, and non-resident aliens received our solicited email and phone call.

The IRS requirement is to ensure that the University has made a “good faith effort” to obtain your SSN. If the IRS deems there was failure to report correctly, any fines or penalty fees will be passed along to you and charged to your student account. Passing along these fees has been approved by University administration and Kansas Board of Regents. This approval can be found in the Comprehensive Fee Schedule (www.wichita.edu/tuition) as departmental cost-recovery fees.

The official IRS form used for requesting your social security number is the W-9S form. Please do not complete a W-9 as this IRS form is when you are a contractor, freelancer or consultant and plan on getting paid by WSU for a provided service.

If you are not required by the IRS to have an ITIN and complete an income tax return, you are not required to provide the information.

International students who are nonresidents for tax purposes are ineligible for the education tax credit and may disregard the solicitation.

Your SSN/ITIN must be on file with the university prior to December 31 in order to have it reported on your form for that tax year.

If you submit your W-9S form late (after December 31), your current 1098-T will not be updated with your social security number. IRS records could be updated if you submit a W-9S form before March 1.

To submit your SSN, please complete the IRS form W-9S and return the form to Student Accounts. Below are the ways to obtain this form.

Direct Link

Click here and complete the form W-9S.

myWSU Portal

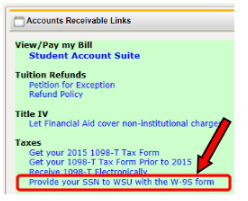

- Log into your myWSU portal

- Go to the myFinances tab

- Click on Provide your SSN to WSU with the W-9S form located in the Accounts Receivable Links box

(Image of Accounts Receivable Links)

Paper Form

Contact Student Accounts at 316-978-3333 if you would like a paper form mailed to you.

Return the completed form to Student Accounts

In person: Jardine Hall Room 201

Mail: Wichita State University, Accounts Receivable, 1845 Fairmount Box 38, Wichita, KS 67260-0038

Fax: 316-978-3107

For information on how to sign up to obtain your electronic 1098-T, click here.